The Mexican states best prepared to accommodate nearshoring investment are Nuevo León, Aguascalientes and Coahuila, according to an analysis conducted by organizations from Mexico and Germany.

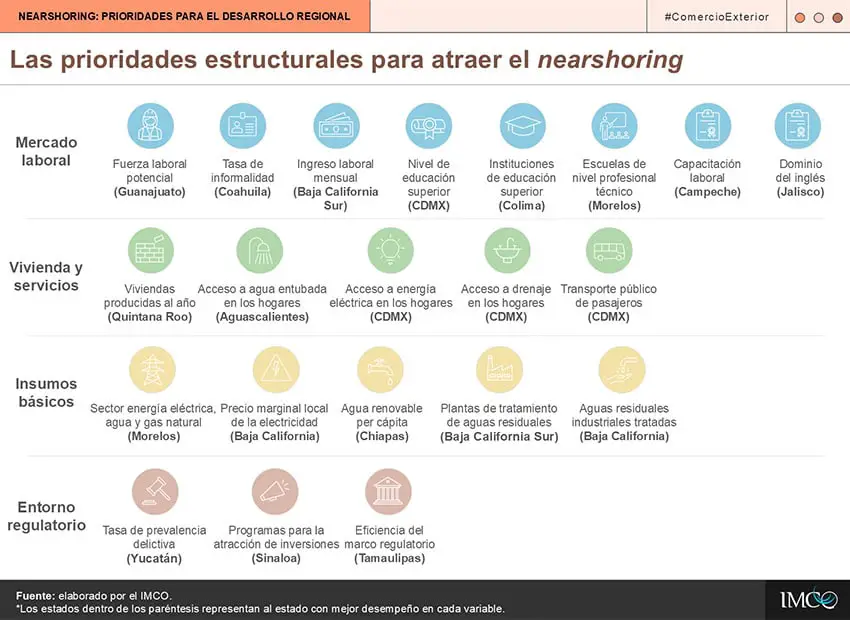

The Mexican Institute for Competitiveness (IMCO) and the Friedrich Naumann Foundation for Freedom (FNF) evaluated the preparedness of all 32 federal entities to receive nearshoring investment based on 21 variables across four key areas: the labor market; housing and services; basic inputs; and the regulatory environment.

The organizations published the results this week in a report entitled “Nearshoring: Priorities for Regional Development.”

“The results show that Nuevo León, Aguascalientes and Coahuila have a better performance than the rest of the states and have the facilities to take advantage of the trend of relocating production chains,” IMCO and FNF said in the executive summary of the report, which was published in English and Spanish.

“In contrast, Oaxaca, México State and Zacatecas are regions whose structural conditions make it difficult to attract investment and increase economic activities related to nearshoring,” the organizations added.

The 21 variables considered in the analysis across the four key areas — as abbreviated by IMCO and FNF — were:

- LABOR MARKET: potential labor force; labor informality rate; monthly labor income; higher education; higher education institutions; technical professional level schools; job training; English proficiency.

- HOUSING AND SERVICES: housing production; piped water access in housing; electricity access in housing; drainage access in housing; public passenger transport units.

- BASIC INPUTS: electricity, water and natural gas sector; local marginal price of electricity; renewable water per capita; water treatment plants; industrial wastewater treatment.

- REGULATORY ENVIRONMENT: crime prevalence rate; investment attraction programs; regulatory framework efficiency.

English proficiency, a friendly regulatory framework and an investment-hungry governor

Nuevo León performed well across all four key areas assessed by IMCO and FNF.

The northern border state ranked among the top 10 entities in 13 of the 21 variables and the top five in nine.

- Nuevo León ranked No. 1 (along with five other states) for the amount of industrial wastewater it treats as a proportion of installed capacity. The state makes full use (100%) of its installed industrial wastewater treatment capacity.

- Nuevo León ranked No. 2 in five variables, including English proficiency and regulatory framework efficiency.

- According to Education First’s English Proficiency Index 2023, which the report cites, residents of Nuevo León have the second best command of English in Mexico after residents of Jalisco. “Given the fact that the main opportunities generated by nearshoring are linked to Mexico’s greater integration into North American production chains, English-language skills also represent an attractive element for investors and transnational companies that may come to the country,” the report said.

- Only 3% of private companies that operate in Nuevo León perceive the regulatory framework as an obstacle to their business objectives, according to the report.

- Among the other variables in which Nuevo León was among the 10 best-ranked entities were housing production (dwellings built annually per capita); electricity prices; and public transport (units per capita).

Governor Samuel García is determined to make Nuevo León Mexico’s foremost nearshoring hub. He has actively courted investment from foreign companies, including during visits to China and Japan last year.

The biggest investment coup for the state during García’s term of government has been Tesla’s announcement that it will build a gigafactory near state capital Monterrey. However, CEO Elon Musk recently said that the project is “paused” pending the outcome of the United States presidential election.

The IMCO/FNF analysis isn’t all good news for Nuevo León. The state ranked among the last 10 entities in seven of the 21 variables. Its worst results were 27th for higher-education institutes per capita and 26th on two indicators related to water.

Where did the rest of the states rank?

As mentioned above, Aguascalientes and Coahuila were also deemed to be well prepared to receive nearshoring investment.

Both states were among the top 10 entities in 11 of the variables. Aguascalientes ranked as the second best state for nearshoring investment ahead of Coahuila as it was only among the bottom 10 states in three variables.

Located in Mexico’s industry-focused Bajío region, Aguascalientes fared well in a range of variables, including one that measures the number of water treatment plants in relation to the quantity of water licensed for industrial use.

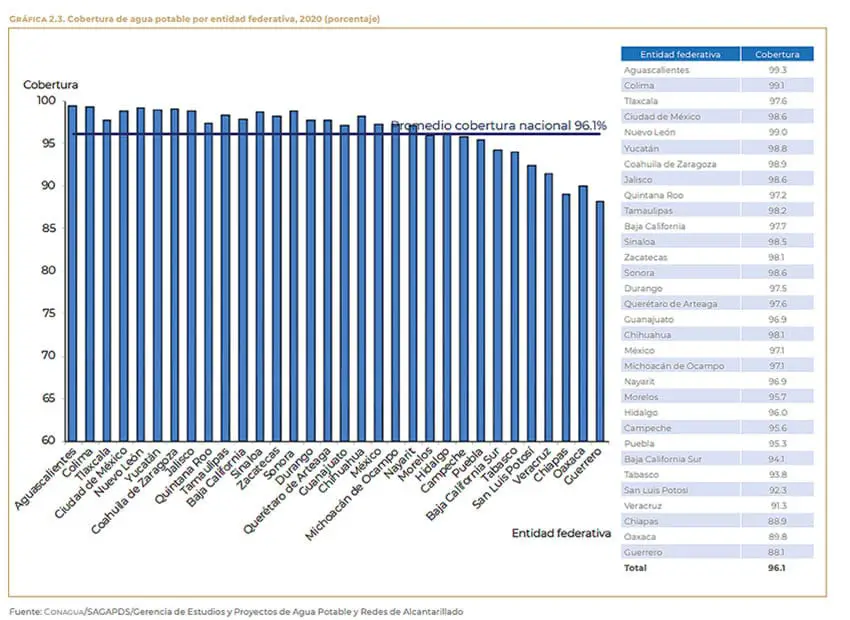

Very few private homes in Aguascalientes lack access to basic services such as piped water and electricity, allowing the state to rank among the top 5 in variables that measure the availability of basic services. It also ranked highly for housing production and for higher-education units per capita and the percentage of the economically active population with tertiary qualifications.

Aguascalientes’ worst result was 30th for the availability of renewable water per capita.

According to the report, Coahuila has the lowest labor informality rate in the country, allowing it to rank first in that variable.

Coahuila ranked No. 3 for the number of technical professional level schools per capita, and also ranked third for the percentage of companies that are aware of government programs aimed at attracting investment in the state.

Its worst result was 32nd (last) for English proficiency, a surprise given that the state borders the United States.

“Nuevo León, Aguascalientes and Coahuila have favorable conditions to attract investment related to nearshoring,” IMCO said in a press release.

“They have more skilled labor, better working conditions and better infrastructure. However, access to water as a basic input is a challenge.”

The nearshoring preparedness rankings of all 32 states appears below.

- Nuevo León (Top 10 on 13 variables/bottom 10 on 7)

- Aguascalientes (11/3)

- Coahuila (11/9)

- Colima (10/10)

- Jalisco (10/10)

- Tamaulipas (9/10)

- Morelos (9/11)

- Yucatán (9/11)

- Sinaloa (8/8)

- Baja California Sur (8/12)

- Tlaxcala (8/12)

- Querétaro (7/9)

- Sonora (7/11)

- Chihuahua (7/12)

- Mexico City (7/13)

- Quintana Roo (7/13)

- Chiapas (6/13)

- Tabasco (6/14)

- Baja California (5/14)

- Michoacán (5/14)

- Campeche (5/15)

- Hidalgo (5/15)

- Nayarit (5/15)

- Durango (5/16)

- Guanajuato (5/16)

- Guerrero (4/16)

- San Luis Potosí (4/16)

- Puebla (4/17)

- Veracruz (4/17)

- Oaxaca (3/17)

- México state (2/17)

- Zacatecas (2/17)

Which states have the most water and the cheapest electricity?

Water and electricity are key considerations for companies planning to operate industrial plants in Mexico. Data shows that while water is more abundant in the south, electricity is cheaper in the north.

According to the IMCO report, Chiapas has more than 20,000 cubic meters of water per capita, easily the highest amount in the country.

Ranking second to fifth were:

- Oaxaca: 13,850 cubic meters per capita

- Tabasco: 12,931 cubic meters per capita

- Yucatán: 9,573 cubic meters per capita

- Durango: 6,939 cubic meters per capita

The entities with the lowest quantity of water per capita were Mexico City, México state, Aguascalientes, Tlaxcala and Guanajuato.

With regard to electricity, the states with the lowest prices per megawatt-hour were:

- Baja California

- Sonora

- Sinaloa

- Chihuahua

- Tamaulipas

The states with the highest power prices were Baja California Sur, Quintana Roo, Campeche, Yucatán and Oaxaca.

Which states have the lowest crime rates and the highest proportion of tertiary-qualified workers?

Among other important considerations for companies considering relocating all or some of their operations to Mexico are crime and the availability of appropriately qualified workers.

Yucatán has the lowest crime prevalence rate per “economic units” or businesses, according to the report. The next lowest rates were in:

- Jalisco

- Tamaulipas

- Chiapas

- Guerrero

The highest crime rates affecting businesses were in Sonora, Mexico City, Durango, Colima and San Luis Potosí.

“In Sonora, CDMX and Durango, more than 3,400 out of every 10,000 businesses reported being victims of crime in 2021,” the report said.

“In Yucatán, the rate was less than 1,300 economic units, while in Jalisco 1,570 out of every 10,000 units reported crime in that year.”

Extortion is one of the top crime threats businesses face in Mexico.

As for the percentage of the economically active population (PEA) with higher-education degrees, Mexico City ranked first. Just over 41% of the capital’s PEA has a tertiary qualification, ahead of Sinaloa (31%), Colima (29.9%), Tamaulipas (29.6%) and Baja California Sur (29.3%).

The five states with the lowest percentage of workers with higher-education degrees were Oaxaca, Guerrero, Chiapas, Guanajuato and Michoacán. The percentages in each of those states is below 20%.

The state with the lowest percentage of companies that perceive the regulatory framework as an obstacle to their business objective was Tamaulipas (2%). Nuevo León and Chihuahua ranked equal second, with just 3% of companies complaining about the regulatory framework in those states.

Chiapas (4%) and Sonora (5%) ranked fourth and fifth, respectively.

In contrast, 82% of companies in Michoacán see the regulatory framework as an obstacle to their business, while the figures are also high in Jalisco (65%) and Puebla (48%).

Mexico News Daily